India Business and Finance, October 24th

What happened in the Indian business world during the past week.

The maturation of India inc.

a) Thriving financial firms

A former senior banker for Barclays and Citicorp, Ashok Vaswani, has been appointed the new chief executive of Kotak Mahindra Bank, replacing its founder Uday Kotak who resigned in response to central bank rules capping his tenure. The tremendous success of Kotak, which emerged over the past three decades from a tiny finance firm to an institution worth $46bn, would normally be seen to be a source of talent for the Indian financial world rather than being an institution requiring an outside infusion. The bank portrayed the hiring as a reflection of India’s heightened position in global finance, which now allows it to attract people from the Indian diaspora who had previously moved abroad for opportunities. Kotak’s market cap is far higher than Barclays ($27bn) and it is not inconceivable that based on recent growth rates, Kotak’s could exceed Citi’s ($76bn) in the not so distant future.

Part of the appeal of Kotak is that it is doing well in an overall system that is doing well. Profits in the most recent quarter were up 24% from the year earlier period, making it merely one of many Indian institutions posting excellent numbers. IDBI Bank’s profits were up 60%, RBL Bank’s 46% and ICICI’s 36%.

b) Troubled financial firms

The venture/private markets, which were at the epicentre of the excitement about India’s future two years ago, are quietly trying to sort themselves out after many firms have failed to deliver on their expansive business plans. Among the changes: increased engagement by limited partners who no longer trust even the most prominent venture firms to track their holdings, and a new financial ratio reflecting success. Rather than merely citing the shift in the overall valuation of portfolio holdings, which had been the key metric but is now seen to be a hollow number, the key ratio now is the amount of money returned to limited partners as a percent of the overall capital base. In an odd way, this transforms the venture fund into the kind of company evaluated based on dividends, a classically conservative approach.

Frugal India

The used handset market has developed into a strong niche in India and now HP and Asus are opening retail outlets to sell refurbished laptops. Asus said it was responding to trends it had witnessed in the marketplace, with 500,000 to 600,000 laptops changing hands in the used market. That is a large number by itself but also large in relation to the new market, which is just over 3m and declining sharply.

But if you do want to sell in India (Google plays ball on local production)

Google announced it will start making its newest smartphone in India beginning in 2024, following the highly publicized steps of Apple and Samsung. The immediate impact will be non-existent – Google’s market share is below 1%. Its phones are hard to buy and harder to get serviced. The only Google Pixel phones I ever see are owned by current and former Google employees and people who live mostly overseas. But with local production will come distribution, including more than two dozen new service centres and the avoidance of steep tariffs. Google obviously has deep resources and provides the software at the heart of most of the handset universe so its potential in the market, regardless of market share, is significant. But the handset cannot be viewed in isolation. If Google wants to maintain good relations in India for the rest of its businesses, it realistically has no choice but to start production not only for local sales but for export. It will apparently also begin production of Chrome Books in India, one of a number of similar announcements around local production that have been made since India imposed, and then withdrew, a strict new licensing regime for computer imports. Evidently a threat by the Indian government was enough to produce the intended results.

Least surprising increase in product popularity

The Business Standard reports sudden demand for air purifiers. In a highly contested race, Mumbai has now passed Delhi among the most polluted cities in the world.

Surprising profit jump

Nestle reported year-on-year profit growth of 37%, sharply better than Hindustan Unilever and Marico. It attributed the large gains to a focus on small towns and villages - ordinarily considered to be a place where Unilever and Marico have unmatched expertise - and an analytics platform called MIDAS. A handful of Indian companies are believed to produce superior returns because of particularly good analytics, notably Asian Paint and Bajaj Finance. Maybe the Swiss giant has devised a better approach.

We hate Justin Trudeau but please understand, this is personal, not business

India has no shortage of targeted business bans on selected countries (most obviously Pakistan and China) and the Canadian business community has been holding its breath since Canada’s prime minister enraged the Modi government with his allegations that India was involved in the murder of Hardeep Singh Nijjar, a Sikh Canadian who the Indian government labelled a terrorist. Several dozen Canadian diplomats have just been booted from the country. But “senior government sources” speaking to the Mint newspaper said there are no plans to limit Canadian investments or imports. While the newspaper says Canadian lentil exports to India have slowed (who knows why), large Canadian pension funds hold billions of dollars in high priority Indian infrastructure projects. No one in Canada or India seems to want to disrupt this sort of investment.

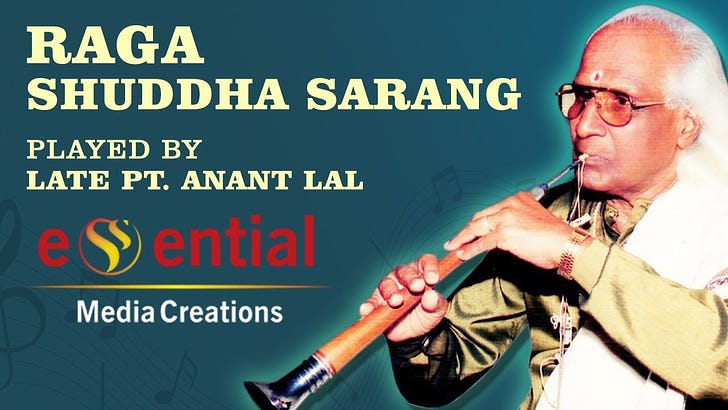

India’s favourite business continues to grow

The brief contraction in the Indian wedding market because of covid-19 is now a distant memory. The Confederation of All India Traders expects 3.5m weddings between mid-November and mid-December, up 9% from last year’s powerful recovery. Total wedding-related sales are predicted to reach Rs4.25 trillion, or $51bn. Included in this spending are hotels, clothing, planning services (which resemble movie productions and can be more expensive), jewellery and travel–not only buses but ordinary plane tickets and charters of seven to ten person planes, along with Airbus and Boeing jets. On the larger flights there are elaborate special meals along with this year’s popular addition: musicians who can play the shehnai, a cross between an old-fashioned trumpet and a clarinet that produces oddly relaxing sounds. India’s aspiring aviation industry, which often operates in the midst of surrounding chaos, should see the value of this last addition and adopt it. If you are stuck in traffic and need a distraction, click on the following link selected from inserting the word shehnai into a Youtube search. Then sleep.